A Look at the Flat Tax and Progressive Tax

Posted by Alejandro Diaz on June 23, 2021This article will argue that the progressive tax system is more equitable than a flat-rate tax system. First, we describe each tax system in the simplest terms possible.

Flat Tax

In a flat tax system, everyone, no matter their background, pays the same tax rate. In the USA, a real-life example is a sales tax for a region. In a flat tax system, no matter how much money you spend at a store or how much money you make, you will pay the same flat percentage. For example, if the tax rate is 10% you would owe $10 on a taxable amount of $100.

Progressive Tax

In a progressive tax system, just like a flat-rate tax, everyone pays the same percentage on the taxable amount, but the taxable amount is broken down or “categorized.” In the USA, this is how federal income tax works. How is money categorized?

Imagine applying a progressive tax to a shopping situation: you would like to buy a $100 item. The tax rate here is 10%, so you pay $10, exactly like in a flat tax system. Ok, so what is the difference? We can apply the progressive tax system to a more expensive example to make the difference obvious. A $200 item under a progressive tax could still take the first $100 and tax it at 10% ($10 paid), then it may take the next $50 and tax it at 20% (another $10), then, finally, the last $50 is taxed at 30% ($15 paid). The total tax paid is $35 on the $200 taxable amount. The $200 example illustrates that a progressive tax system divides taxable amounts into brackets, with each subsequent tax bracket increasing in rate.

Regressive Tax

I will not discuss the regressive tax system any further after this section. The inequality of the regressive tax system is a fair bit more obvious. A regressive tax is the same as a progressive tax but flipped. That is, the higher tax rates come in the first buckets and progressively decrease. Using the $200 purchase as an example: the first $100 is taxed at a 30% rate ($30), the next $50 at 20% ($10), and the last $50 at a 10% tax rate ($5), for a total of $45 paid.

A quick aside

I mentioned buckets/brackets and example tax rates in the previous examples. I want to add a caveat, the buckets and the tax rates are arbitrary. That is, the tax rates and bracket are flexible and often change.

Another aside is that there is a popular belief that accepting a pay raise will “push them into a higher tax bracket.” It is important to remember that these buckets are independent. Money gets passed through them at all stages, and you never pay more than you earned (in the case of an income tax). In other words, you will always get a portion of each additional dollar, no matter what bracket that money goes into. It is always better to take more money if offered.

Why is the Flat Tax not an Equitable Tax Policy?

We have established a basic definition of each system. A flat tax charges the same rates to everyone. A progressive tax system breaks money up into brackets, with each bracket taxed at a different, increasing tax rate. A regressive tax system also breaks money into tax brackets, but the higher tax rates occur at lower tax brackets. We now discuss flat-tax and progressive tax systems as they pertain to income.

We will show why the flat tax rate system is less equitable to lower-income taxpayers using an example. I built a simple spreadsheet that illustrates the progressive tax system for 4 set buckets (these buckets are not changeable in this example!).

For the progressive tax system:

- The first $500 in this system is tax-free

- The next $1000 is taxed at 6%

- The next $5000 is taxed at 15%

- Anything beyond that ($6500<) is taxed at 25%. So only income more than $6500 is taxed at the 25% rate.

These tax brackets work better with incomes ranging from $3,000 to $15,000 because there are only four tax brackets (real-life systems have many more brackets). Nonetheless, this system will work as an illustration of how inequitable the flat tax system is.

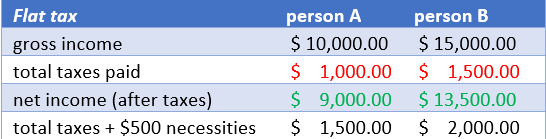

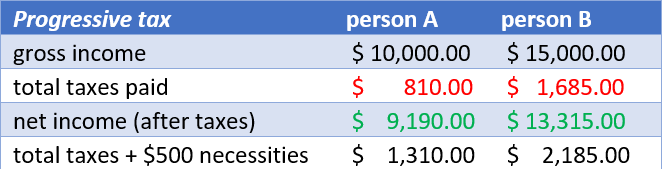

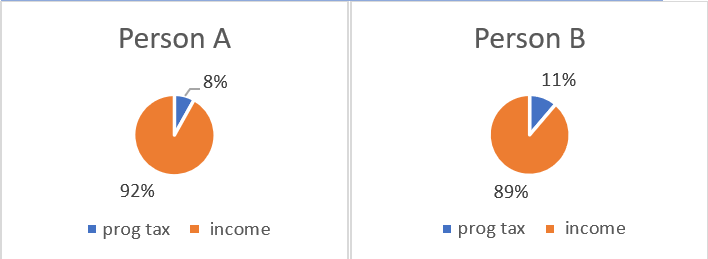

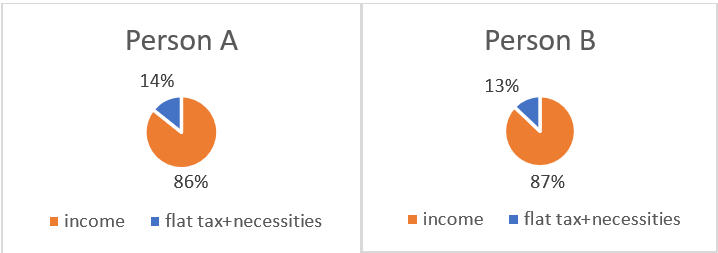

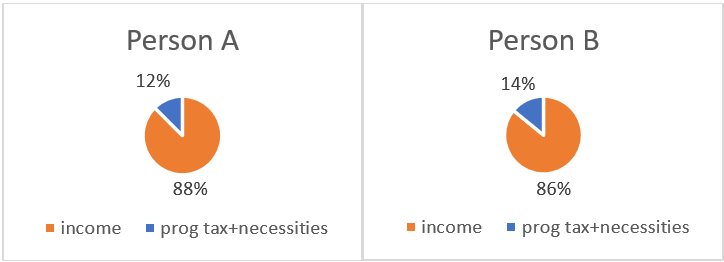

We look at a $10,000 earner (Person A) and a $15,000 earner (Person B) under both systems. We plug into the calculator the incomes, and we are left with the following:

I set up the example so that both the flat tax and the progressive tax systems generate almost the same revenue. As you can see, in both tax systems, the higher earner pays a higher total tax.

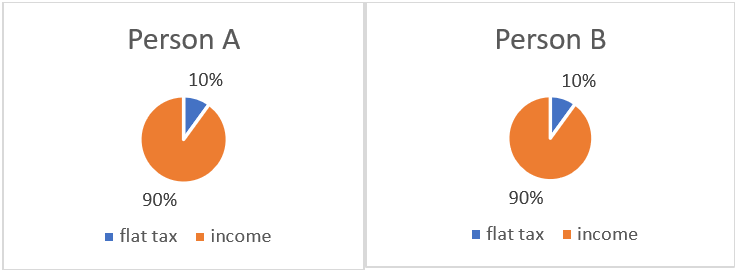

Here is the vital bit, the meat of the argument: we can see in the graphs above that, all else equal (i.e., revenue generated), the flat-tax system taxes poorer earners more of their income by percentage than the wealthier earner. That is, that when looking at the percentage of the income tax, there is more burden on the lower-income earner.

The tax burden is compounded further when you consider that the poorer earner is also going to spend more of their income as a percentage on necessities, reducing their real income even further, if you consider necessities as a “tax” you can already see how unbalanced the flat tax system becomes.

With necessities

In this example we add a flat cost of $500 to both person A and person B as a stand in for basic expenses (food, hygiene):

Conclusions

The heart of the argument against a flat tax is:

- Compared to a progressive tax, a flat tax places a higher burden on lower-income taxpayers.

Lower-income earners will have to use a higher percentage of their incomes to buy goods when compared to a progressive tax that considers that lower-income earners must use a threshold amount of money to fulfill basic needs of life. As illustrated in our example, flat tax results in smaller taxes as a percentage of income for the wealthy. The flat tax is a less equitable tax system.

All three systems can, in theory, charge lower amounts when compared to other systems. Proponents of either the flat tax system or the regressive tax systems may use this to make convincing arguments for their tax system of choice. Be wary of this argument. To generate the same tax revenue as the progressive tax system inherently means that lower and middle-income earners will carry an inequitable tax burden compared to higher-income earners. A policymaker can always propose a lower tax to begin a system, but as the needs of the budget increase, they will have to increase taxes, and that new great rate they offered has ended up being a bait and switch.

‘Till next time space cowboy

– Alex